The SoHo Loft Capital Creation Event Series Announces the Agenda for the Capital Creation and Crowdfunding Conference

in Los Angeles

BriefingWire.com, 2/24/2012 – Roswell, GA, Feb. 24, 2012 — Today the SoHo Loft announced the agenda for its upcoming Capital Creation and Crowdfunding Conference, the definitive forum for learning about the rapidly evolving marketplace for private company stock. The two-day event will be held in Los Angeles, CA on Tuesday, March 13th and Wednesday, March 14th.

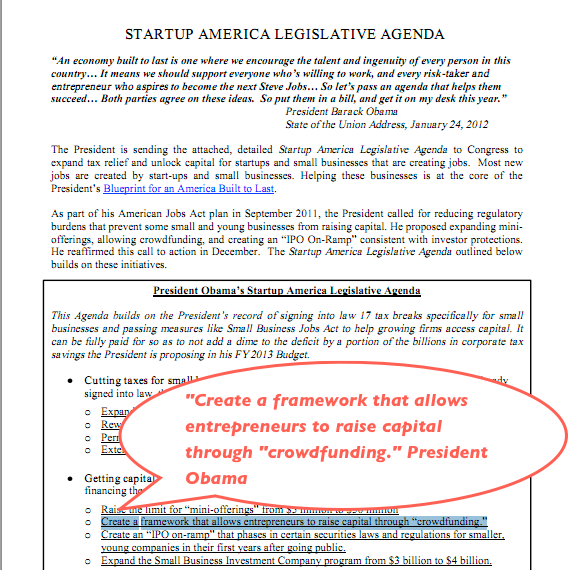

In this remarkable moment in history, the U.S. regulatory environment, its capital markets and the innovation that drives those markets are simultaneously on the threshold of dramatic change. We are currently witnessing the embryonic period of a cutting-edge stock market just as we usher in a new era of mass media. At the same time, new legislation aimed at facilitating capital formation is being introduced to support this modern infrastructure. There has never been a more opportunistic time to capitalize on change.

TSL’s Capital Creation and Crowdfunding Conference provides attendees with key insight into the direction of the U.S. capital markets during this period of regulatory transformation and the rapid progression of the developing ecosystem. Attendees will get a fresh look at how capital formation is changing as well as learn where new growth opportunities exist, how social media is transforming Wall Street and most importantly, how to capitalize in this changing paradigm.

Attendees will also get to know the players who are shaping the Private Company Marketplace (PCM) including the private shares desks and exchange platforms, crowdfunding experts, secondary private share buyers and angels, private stock analysts, legislators and seasoned entrepreneurs. There will also be ample networking sessions to exchange ideas, discourse and opportunities.

THE AGENDA:

DAY ONE: CROWDFUNDING – TUESDAY, MARCH 13TH

· 1pm – Registration, pre-networking, Demos

· 130pm – Opening Remarks and Introduction

· Employing Crowdfunding to Enhance Capital Formation and Create Jobs

· Rep. Patrick McHenry to discuss his bill, HR 2930 also known as the “Crowdfunding billâ€

· “How you can make a difference and be heard†by Jason Best, Co-Founder and partner of Startup Exemption

· 3 to 330pm – Coffee Break: Snacks and Networking Under the Buttonwood Tree

· The Capital Markets of Tomorrow – Meet The Pioneers of Crowdfunding

· 330 to 415pm Panel: “Legalize it†– The transforming regulatory landscape to introduce a new asset class

· Panelists include:

1. Jason Best, Co-Founder of Startup Exemption

2. Jouko Ahvenainen, Co-founder of Grow VC

3. Richard Salute, Capital Markets and SEC Practice Director with J.H. Cohn

4. Mitchell Littman, Esq., founding partner of Littman Krooks LLP

· 415pm to 445pm Panel: The relationship between Angels and Crowdfunding

· Panelists include:

1. Julia Dilts, Co-Founder and CEO of Maverick Angels

2. Charles Sidman, Managing Partner of ECS Capital Partners and Angels

3. Wil Schroter, Serial Entrepreneur & CEO of Virtucon Ventures

4. Candace Klein, Founder and CEO of Bad Girl Ventures and SoMoLend

5. Connie Koch, President of the Southern California Region of Keiretsu Forum

· 445pm to 515pm Panel: Establishing the Infrastructure to enhance Crowdfunding:

· Panelists include:

1. Gene Massey, CEO of MediaShares

2. William Davis, President of Gate Impact

3. Alon Hillel-Tuch, Co-Founder of RocketHub

4. Steven A. Cinelli, Founder, CEO, PRIMARQ Inc.

· 515 to 545pm – Coffee Break: Snacks and Networking Under the Buttonwood Tree

· 545pm to 7pm – Presentations:

· 545pm: Case Study: One start-up’s experience utilizing Crowdfunding

· 605pm: “Models and approach to building the new sustainable finance sector†by Jouko Ahvenainen, Co-founder of Grow VC

· 625pm: “Transforming an Idea into a Business†by Julia Dilts, Co-founder and CEO of Maverick Angels

· 645pm – Closing Remarks, Meet our Sponsors

· 7pm – Cocktail Party, Extensive Networking

To register for tickets, please visit http://tslccla.eventbrite.com/. Only ticket holders will be permitted into the event. Press Passes will be provided to qualified members of the media at no charge. To receive Press Passes, please contact dsa@thesoholoft.com. To view detailed bios of our distinguished speakers, please visit http://www.thesoholoft.com/our-network/speakers-2/

ABOUT THE SOHO LOFT CAPITAL CREATION EVENTS:

The Soho Loft Capital Creation (TSLCC) Event Series is the only global event platform where accredited investors; accomplished angels; microfinancing groups; CIOs of investors; select merchant and investment bankers; VCs; family offices; incubators; private equity firms; pre-IPO mutual funds; secondary stock buyers, sellers and equity analysts from across the world assemble in order to exchange ideas, discourse and opportunities that will help reshape the capital markets and stimulate economic growth. Our mission is to bring awareness and drive capital to the private company marketplace (PCM) as well as to help develop its infrastructure so that it can mature into a viable and functional institutional marketplace that facilitates capital formation, innovation, expansion and job creation. For additional information please visit us at http://thesoholoft.com and www.facebook.com/TheSohoLoftevents.

ed crowdfunding has shown that winning ideas can secure adequate seed financing. Two examples stick out. On Kickstarter 13,512 people donated almost $1M to two entrepreneurs to develop the Nano Watch. They now employee 10 people and believe that TikTok has led to an additional 45 support related jobs for the company. In the UK, The Rushmore Group, raised  £1M from 143 Investors on a Crowdfund Investing platform. The expansion capital will create over 30 full time jobs, many more part-time jobs and additional support jobs. “These two examples,†Neiss says, “show the power that crowdfunding can have in creating jobs. Crowdfunding is much akin to community financing where an entrepreneur will pitch his idea to his or her social network. Provided that the idea has merit, the entrepreneur is seen as trustworthy, the business model makes sense and the investment opportunity is worthwhile, people will invest.â€

ed crowdfunding has shown that winning ideas can secure adequate seed financing. Two examples stick out. On Kickstarter 13,512 people donated almost $1M to two entrepreneurs to develop the Nano Watch. They now employee 10 people and believe that TikTok has led to an additional 45 support related jobs for the company. In the UK, The Rushmore Group, raised  £1M from 143 Investors on a Crowdfund Investing platform. The expansion capital will create over 30 full time jobs, many more part-time jobs and additional support jobs. “These two examples,†Neiss says, “show the power that crowdfunding can have in creating jobs. Crowdfunding is much akin to community financing where an entrepreneur will pitch his idea to his or her social network. Provided that the idea has merit, the entrepreneur is seen as trustworthy, the business model makes sense and the investment opportunity is worthwhile, people will invest.â€